So DO Tax Cuts Create Jobs?

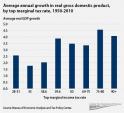

That’s definitely not what happened. In fact, growth was actually fastest in years with relatively high top marginal tax rates. Back in the 1950s, when the top marginal tax rate was more than 90 percent, real annual growth averaged more than 4 percent. During the last eight years, when the top marginal rate was just 35 percent, real growth was less than half that.

Altogether, in years when the top marginal rate was lower than 39.6 percent—the top rate during the 1990s—annual real growth averaged 2.1 percent. In years when the rate was 39.6 percent or higher, real growth averaged 3.8 percent. The pattern is the same regardless of threshold. Take 50 percent, for example. Growth in years when the tax rate was less than 50 percent averaged 2.7 percent. In years with tax rates at or more than 50 percent, growth was 3.7 percent.

These numbers do not mean that higher rates necessarily lead to higher growth. But the central tenet of modern conservative economics is that a lower top marginal tax rate will result in more growth, and these numbers do show conclusively that history has not been kind to that theory.

Zaid Jilani at CAP’s Think Progress also takes a look, in Top Reagan Economic Advisor: Return To Clinton-Era Tax Rates Would Not Hurt Economic Growth,

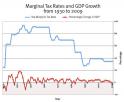

Historically, the United States has actually had some of its strongest periods of economic growth while taxes were high. As this graph from Slate shows, some of our strongest periods of growth in gross domestic product actually occured while taxes were very high:

In the 1950s, which had one of the sharpest periods of economic growth in all of American economic history, the top marginal tax rates for the richest Americans stretched above 90 percent. Likewise, economic growth in the relatively higher-taxed 1990s was much stronger than in the 2000s. This isn’t to say that higher taxes necessarily cause greater economic growth, but it does seem to show that higher taxes do not appear necessarily to be impeding job growth, nor are lower taxes especially helpful.

OK, did you see those charts? Not only do high taxes on the rich not impede growth, but growth looks to be higher when taxes are higher. Maybe this is because higher taxes on the rich means that the government — We, the People — has more to spend on the things that make our economy more efficient and competitive like schools, roads, bridges, transit systems, courthouses, judges, etc…

And, again, the periods of low taxes are the periods of government cutbacks …

David Leonhardt at the NY Times looks at recent numbers, in Do Tax Cuts Lead to Economic Growth?

President George W. Bush and Congress, including Mr. Ryan, passed a large tax cut in 2001, sped up its implementation in 2003 and predicted that prosperity would follow.

The economic growth that actually followed — indeed, the whole history of the last 20 years — offers one of the most serious challenges to modern conservatism. Bill Clinton and the elder George Bush both raised taxes in the early 1990s, and conservatives predicted disaster. Instead, the economy boomed, and incomes grew at their fastest pace since the 1960s. Then came the younger Mr. Bush, the tax cuts, the disappointing expansion and the worst downturn since the Depression.

(Click that graphic for larger)

Page 2 of 3 | Previous page | Next page